Buyer - Frequently Asked Questions

Q: What is a Showing?

Q: Why do we have to schedule a showing?

Q: Why did the Seller decline our showing request?

Q: Why do we need to drive by a Home before we schedule a showing?

Q: What does Buyer Pool mean?

Q: How do I know when I've found the right home?

Q: What are needs vs. wants?

Q: What is the best way to decide which home we like the most?

Q: How many homes should we expect to look at before we submit an offer?

Q: Why do I need to submit an offer ASAP?

Q: What is a multiple offer situation?

Q: What is meant by Best and Highest?

Q: What should I expect once I write an offer?

A: It essentially boils down to 3 primary steps.

1. Offer Acceptance

a. Getting an offer accepted may require multiple counter offers between Buyer and Seller to come to agreement on the price, terms and conditions. If the Buyer and Seller cannot come to agreement on price, terms and conditions, then the Buyer will walk away and the Seller continues to market the house and find another Buyer.

b. A contract is not valid until both the Buyer and Seller accept price, terms and conditions within the contract period or before the contract expiration date.

c. If the Seller counters the Buyer's offer, the Seller is essentially out of contract and if the Buyer does not respond, there is NOT a valid contract.

2. Inspection Response

a. You will want to have a whole house inspection. The licensed inspector will go over the whole house and report any findings that could affect the home such as safety, major defects or repair items ... etc. If the inspection reveals any MAJOR Defects such as foundation, structural or other significant issues with plumbing, electrical, mold ... etc., the Buyer can cancel the contract but typically we would ask the Seller to repair these items.

b. If the Buyer's inspection reveals a significant number of defects that require repair such as rotted wood around windows, malfunctioning sump pump, failed window seals ... etc. and the Buyer & Seller cannot come to agreement on the repairs, the contact can be cancelled.

c. It's important to respond to the inspection response quickly since contracts have a clause stating if the Buyer does not respond within the time period allowed by the Seller, then the Buyer agrees to accept the home per the Seller's response which may mean that the Seller does not want to fix some items.

3. Financing Approval

a. When the Buyer is getting a loan (Financing), there is a process that the Buyer's Lender (Bank) has to go through to approve the loan for the Buyer. This typically takes around 30-45 days and requires that the Buyer provide proof of income, tax returns, credit report, lender appraisal, review of title, compliance with Lender underwriting guidelines ... etc. Even though you get a preapproval letter, it's possible that financing could be denied at any point during the 30-45 day process due to an underwriting stipulation (issue) that can not be resolved to meet the underwriter's lending requirements. This would terminate the contract.

b. The Buyer's Lender will require an Appraisal.

Q: What are Purchase Agreement Terms and Conditions?

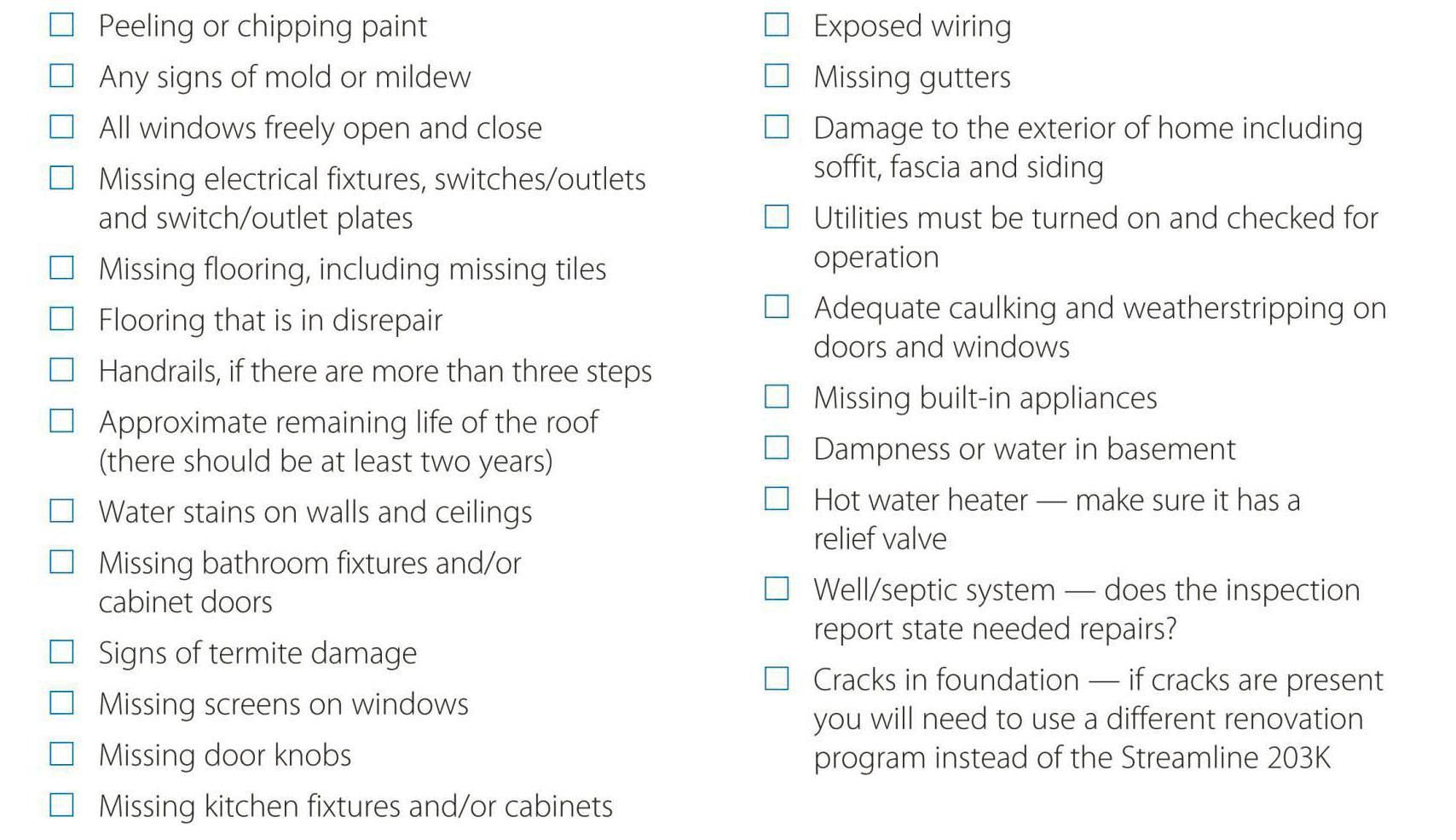

Q: What are common issues found during an inspection?

Q: What is Radon?

Q: What are prorated taxes?

Q: What is Earnest Money?

Q: What is the difference between Closing Fee and Closing Costs?

Q: What is a Buyer's Agent?

Q: I thought you were an employee at FC Tucker so any agent could help me?

Q: What do you charge to help us find a home?

Q: What are Seller Paid Concessions?

Q: What is a Home Warranty?

Q: What is a HUD statement?

Q: What is a Preapproval or Proof of Funds?

A: Preapproval Letter vs. Proof of Funds

1. Preapproval Letter

a. Provided by the Buyer's Lender (Bank) that basically says the Lender has pulled the Buyer's credit report to verify the Buyer's credit worthiness and has discussed the buyer's income and debt such as car or student loans, time on job ... etc. to confirm that the Buyer SHOULD meet the Lender's underwriting guidelines to give the Buyer a loan to buy a home.

c. The underwriter is the Lender's decision maker. The Loan Officer is the person collecting all of the underwriter's required documentation from you and the Loan Officer advises you on what to do and what not to do. The loan officer will also make you aware of any underwriter stipulations that need to be taken care of before the loan can be approved.

d. A stipulation could be something that is found during the underwriting process that would void your ability to qualify for a loan and needs to be rectified, if possible, before the underwriter can approve your loan also called "Clear to Close". A major stipulation could be a foreclosure you had years ago, however, when your old bank took the property they didn't sell it until recently (transfer of title). Another example of a stipulation that can be easily resolved would be the underwriter needing an additional pay stub or letter of explanation regarding the checking deposit you made when you received an unexpected bonus from your employer.

b. Your loan officer will guide you through the process of financing approval and PLEASE DO YOUR BEST TO COMPLY WITH THE LOAN OFFICER'S REQUEST ASAP as any delay on your behalf will delay your ability to close on time. Please understand, its very common to wonder why your loan officer is asking for what may seem to be a ridiculous request for additional documents or updated documents you have already provided like bank statements or pay stubs but these requirements are being generated from underwriting in order to approve your loan. After the 2008 real estate crash, a number of compliance regulations were implemented for lenders and the lenders can be held responsible for pay back of your loan if they do not properly process your loan per these guidelines.

2. Proof of funds is provided by a CASH buyer showing that they have enough money in an account to purchase a home. It could be a bank account or stock portfolio statement or letter from their bank ... etc. Lenders also require a proof of funds from a buyer who is getting financing to ensure the buyer has enough money for their down payment and closing costs.

Q: Why can't I buy furniture on credit before I close on my new home?

Q: Why can't we close on the date specified in the Purchase Agreement?

Q: Why does the Buyer need 45 days to close?

Q: What does the title company do?

Q: What is a closing and closing packet?

Q: Why is the Seller being so difficult with our inspection Response?

Q: What is an Open House?

Q: What if I want to build a new home?

Remember, I represent YOUR fiducial interest and the builder pays the FC Tucker Broker fee. Before I became a REALTOR, I purchased a new construction home without a REALTOR and I regretted it many times. For example, I had issues during the construction process and no one to help me get them resolved. They told me it was a common construction practice per BAGI specs. I felt pressured into using their in-house financing company and they assured me I didn't need an inspection on new construction which came back to haunt me later and no recourse with the builder. Most builders are great to work with, but my past clients have told me it was nice having peace of mind with a real estate professional on their side.

Q: Is it normal to feel anxiety during the home buying process?

Q: What is my recourse if the Seller cannot execute the contract?

Q: What is a Mutual Release?

Q: What is the Seller's Disclosure?

Q: What is an Appraisal?