Seller - Frequently Asked Questions

Q: When will my house sell?

Q: What does Buyer Pool mean?

Q: I received an offer right away, shouldn't I hold out for a higher offer?

Q: What is a multiple offer situation?

Q: What is meant by Best and Highest?

Q: What should I expect once I have an offer?

A: It essentially boils down to 3 primary steps.

1. Offer Acceptance

a. Getting an offer accepted may require multiple counter offers between Buyer and Seller to come to agreement on the price, terms and conditions. If the Buyer and Seller cannot come to agreement on price, terms and conditions, then the Buyer will walk away and the Seller continues to market the house and find another Buyer.

b. A contract is not valid until both the Buyer and Seller accept price, terms and conditions within the contract period or before the contract expiration date.

c. If the Seller counters the Buyer's offer, the Seller is essentially out of contract and if the Buyer does not respond, there is NOT a valid contract.

2. Inspection Response

a. Most Buyers will have a whole house inspection. If the inspection reveals any MAJOR Defects such as foundation, structural or other significant issues with plumbing, electrical, mold ... etc., the Buyer can cancel the contract. Unless you know that your house is in great condition, I always recommend a pre-sale inspection especially on older houses.

b. If the Buyer's inspection reveals a significant number of defects that require repair such as rotted wood around windows, malfunctioning sump pump, failed window seals ... etc. and the Buyer & Seller cannot come to agreement on the repairs, the contact can be cancelled.

c. It's important to respond to the inspection response quickly since contracts have a clause stating if the Seller does not respond within the time period allowed by the Buyer, then the Seller agrees to make the repairs.

3. Financing Approval

a. When the Buyer is getting a loan (Financing), there is a process that the Buyer's Lender (Bank) has to go through to approve the loan for the Buyer. This typically takes around 30-45 days and requires that the Buyer provide proof of income, tax returns, credit report, lender appraisal, review of title, compliance with Lender underwriting guidelines ... etc. Even though the Buyer will provide us a preapproval letter, it's possible that financing could be denied at any point during the 30-45 day process which would terminate the contract.

b. The Buyer's Lender will require an Appraisal.

Q: What are Purchase Agreement Terms and Conditions?

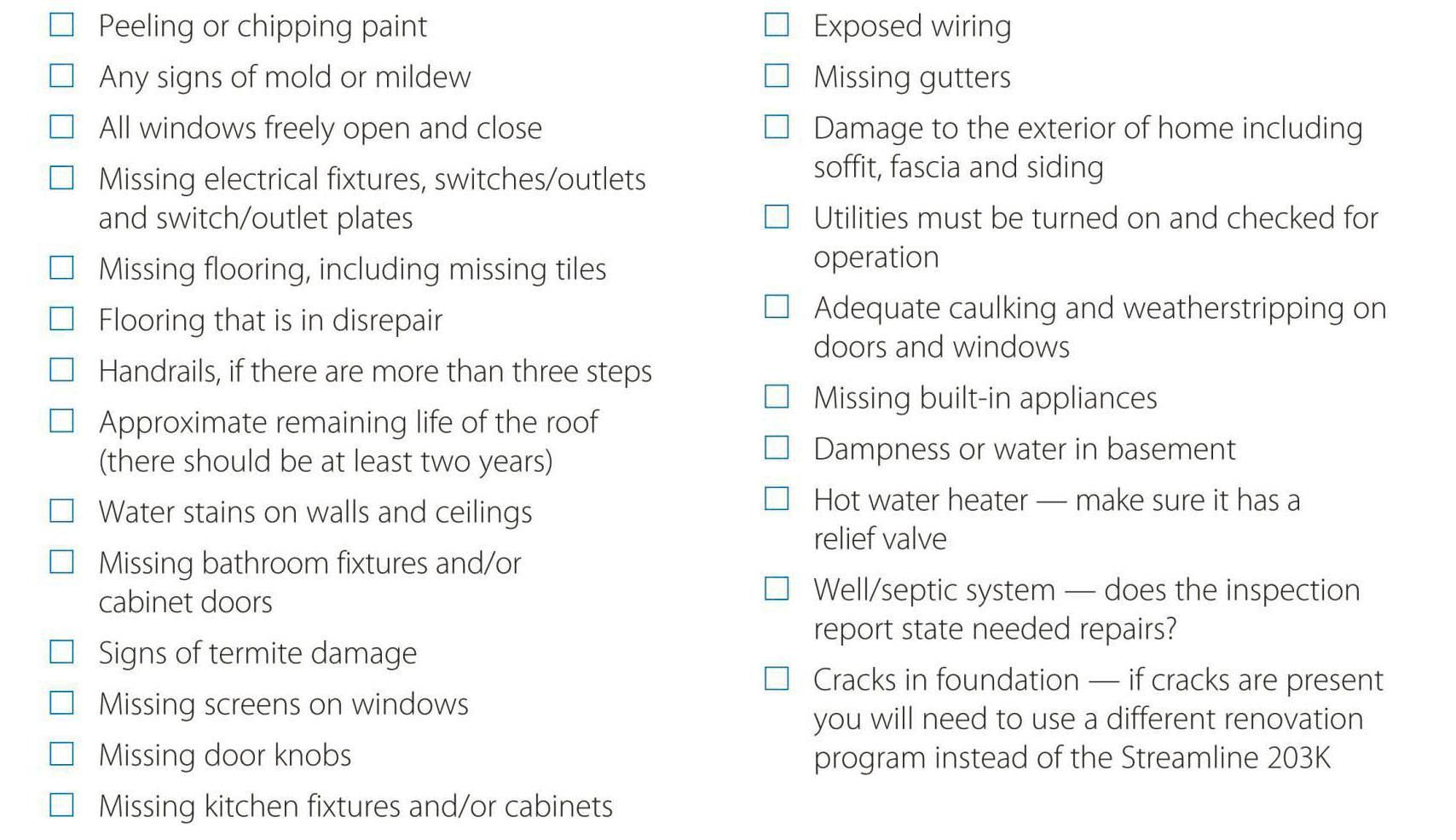

Q: What are common issues found during an inspection?

Q: What is Radon?

Q: What are prorated taxes?

Q: What is Earnest Money?

Q: What is the difference between Closing Fee and Closing Costs?

Q: What is a Preapproval or Proof of Funds?

Q: Why is showing feedback important?

Q: Why can't we close on the date specified in the Purchase Agreement?

Q: I thought you were an employee at FC Tucker so any agent could help me?

Q: Will you cut your commission?

Q: What is a co-op Agent?

Q: Why is it important to show my house whenever possible?

Q: Why does the Buyer need 45 days to close?

Q: What does the title company do?

Q: What is a closing and closing packet?

Q: What are Seller Paid Concessions?

Q: What is a Home Warranty?

Q: What is a HUD statement?

Q: Why is the Buyer being so picky with their inspection response?

Q: Why is staging and maintaining the home important?

Q: Why didn't the Buyer take off his shoes or why did they use my bathroom?

Q: The Buyer left the back door open?

Q: Why can't I let my pet run loose in the house during a showing?

Q: I smoke in the house, but can't I just open a window?

Q: Why do I have to leave the house during a showing?

Q: What about my personal items like a laptop or jewelry during a showing?

Q: What is an Open House?

Q: Is it normal to feel anxiety during the house selling process?

Q: What is my recourse if the Buyer cannot execute the contract?

Q: What is a Mutual Release?

Q: What is the Seller's Disclosure?

Q: What is an Appraisal?